Markets Review

The second quarter began with a continuation of the risk-off environment from the first quarter. Markets troughed on April 8th (Liberation Day), before staging a high beta, low quality rally for the remainder of the quarter. Elements that sustained the rally were administration delays in the tariff implementation date, hyperscale commitment to outsized AI capex plans among growth-oriented SaaS technology companies, and the resilience of broader consumer spending trends as both individuals and companies front-loaded imports ahead of tariffs. Solid labor market readings and stable-to-lower than expected inflation data kept the Federal Reserve (Fed) on the more hawkish course they took in December. Chairman Powell held rates steady at the June FOMC meeting and is not bowing to political pressure to cut rates sooner than the committee’s analysis indicates. The Fed will continue to maintain a measured approach going forward, updating their economic projections and forecasts to two rate cuts in 2025. Deficit scrutiny increased as the One Big Beautiful Bill Act proceeded through Congress. This was highlighted by Moody’s downgrading the U.S. credit rating from Aaa to Aa1 – the last of the major rating agencies to downgrade the U.S. over the past 14 years.

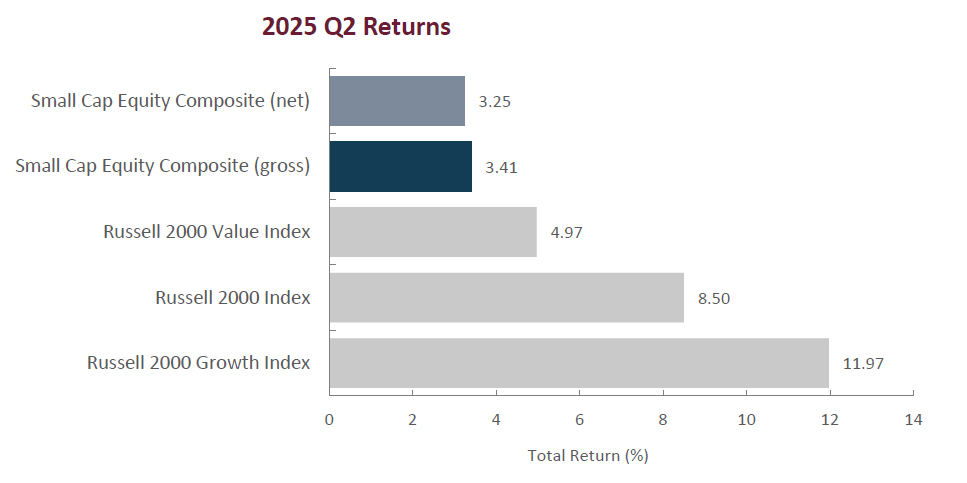

Stylistically, growth stocks outperformed their value counterparts during the quarter as the Russell 2000 Growth Index returned 11.97% compared to the 4.97% return of the Russell 2000 Value index. This continues the 2024 trend where growth significantly outperformed value.

From a factor perspective, lower quality companies outperformed higher quality companies. Factors that had the highest payoff were high beta, non-earners, high sales growth, momentum and cyclical stocks.

At the sector level, cyclical stocks outperformed defensive stocks. The best performing sectors were Information Technology (+21.32%), Industrials (+15.67%), and Materials (+13.01%) while the worst performing sectors were Real Estate (-1.87%), Utilities (-1.28%), and Consumer Staples (-0.98%).

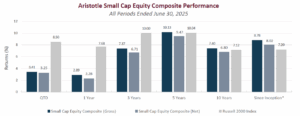

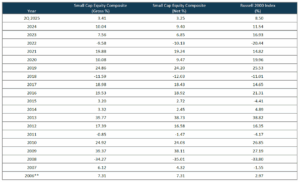

Sources: CAPS Composite Hub, Russell Investments

Past performance is not indicative of future results. Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses. Aristotle Small Cap Equity Composite returns are preliminary pending final account reconciliation. Please see important disclosures at the end of this document.

Performance Review

For the second quarter of 2025, the Aristotle Small Cap Equity Composite posted a total return of 3.25% net of fees (3.41% gross of fees), underperforming the 8.50% total return of the Russell 2000 Index. The largest detractor from relative performance was security selection in Consumer Discretionary, Health Care and Information Technology. This was partially offset by strong security selection in Communication Services coupled with an overweight allocation to Information Technology and Industrials.

| Relative Contributors | Relative Detractors |

|---|---|

| Dycom Industries (DY) | Chemed (CHE) |

| MACOM Technology Solutions (MTSI) | ACI Worldwide (ACIW) |

| Advanced Energy Industries (AEIS) | Merit Medical Systems (MMSI) |

| Itron (ITRI) | Liquidity Services (LQDT) |

| TKO Group Holdings (TKO) | Huron Consulting Group (HURN) |

CONTRIBUTORS

Dycom Industries (DY), a provider of engineering and construction services to the telecommunications and cable television industries, benefitted from continued growth in its core business, funding tailwinds, and expanding margins as demand for wireline services continues to grow. We maintain our position as we believe the company remains well positioned for longer-term growth alongside secular trends for expanding fiber deployments to support faster broadband connectivity speeds and opportunities to deploy fiber to rural or underserved areas across the country.

MACOM Technology Solutions (MTSI), a designer and manufacturer of high-performance semiconductor products, surpassed analyst expectations and raised forward guidance bolstering the stock. We maintain our position, as we believe the company’s meaningful exposure to growing demand from Data Center and 5G end market applications along with the integration of recent acquisitions and domestic manufacturing footprint should drive additional shareholder value in periods to come.

DETRACTORS

Chemed (CHE), engages in the provision of healthcare and maintenance services operating through two segments: VITAS and Roto-Rooter. The VITAS segment offers hospice and palliative care services to patients through a network of health care providers, social workers, clergy, and volunteers. The Roto-Rooter segment includes plumbing, drain cleaning, water restoration, and other related services to residential and commercial customers. The stock declined due to concerns surrounding the potential Medicare cap limits proposed in current legislation for its VITAS segment alongside weaker residential demand for its plumbing services segment. We continue to maintain our position, as we believe the slowing demand in the Roto-Rooter segment is transitory and the secular demand for hospice care remains strong.

ACI Worldwide (ACIW), is a provider of software solutions to facilitate payment transactions for financial institutions, retailers, and payment processors around the world. The company reported strong Q1 earnings and reaffirmed FY 2025 guidance, yet the stock price declined due to investor sentiment around macroeconomic concerns. We maintain our investment as we believe the company has a strong market position in the payments software niche segment. New revenues with higher incremental margins and effective cost controls should allow management to delever the balance sheet while continuing to deliver value to shareholders.

Recent Portfolio Activity

| Buys/Acquisitions | Sells/Liquidations |

|---|---|

| Alight (ALIT) | Berkshire Hills Bancorp (BHLB) |

| Flowserve (FLS) | Columbus McKinnon (CMCO) |

| Guardian Pharmacy Services (GRDN) | JBG SMITH Properties (JBGS) |

| Interparfums (IPAR) | Monro (MNRO) |

| ScottsMiracle-Gro (SMG) | Tronox (TROX) |

| Verra Mobility (VRRM) |

BUYS/ACQUISITIONS

Alight (ALIT), operates a cloud-based platform that provides human capital management and benefits administration solutions to mostly Fortune 500 companies. We believe the company has the opportunity to grow its business through the expansion of existing client relationships along with attracting new clients to their platform. Self-help initiatives implemented by the new CEO coupled with technological enhancements to the platform are expected to streamline operational costs and improve margins on a go-forward basis.

Flowserve (FLS), manufactures and provides aftermarket services for comprehensive flow control systems critical to a diverse range of end markets. We view the company as having an established track record of strong operating and financial fundamentals and the stock was trading at an attractive valuation. Subsequent to initiating the position, the company announced a merger with Chart Industries (GTLS) that is expected to enhance the combined companies’ ability to provide more products and services to their global customers’ projects.

Guardian Pharmacy Services (GRDN), is a leading provider of pharmacy services to long-term care assisted living and behavioral health facilities in the U.S. The company has built a market leading position as a result of a differentiated technology-driven service offering that benefits patients, facility operators and payors. We believe the company is well positioned to continue to capitalize on the secular trend of the aging U.S. population and grow faster than the overall market because of their specific service offering.

Interparfums (IPAR), is a global manufacturer, marketer and distributor of fragrance products in the United States and Europe. The company focuses on the prestige fragrance market and has licensing deals with brands such as Jimmy Choo, Coach, Lacoste, Guess and DKNY, to name a few. We believe the company is well positioned to capitalize on the increased demand for fragrances in the US, China and amongst younger consumers. This secular trend coupled with continued new product innovation and the potential for additional licensing partnerships are expected to enhance shareholder value over the next several years.

ScottsMiracle-Gro (SMG), is a leading manufacturer of branded consumer lawn and garden products in North America. After benefitting from increased demand during the COVID lockdown years, the company experienced several years of below normal growth. As demand has begun to normalize to pre-COVID levels and the company unwinds a poorly executed diversification strategy, shareholder value is expected to be enhanced through margin expansion, balance sheet deleveraging.

Verra Mobility (VRRM), is a provider of automated enforcement, tolling, and parking technologies and solutions. We believe the company is well positioned to benefit from accelerating automated enforcement tailwinds as legislative support and expanding use cases drive adoption by municipalities seeking safer more efficient roadways. We also view the combination of highly recurring long-term contracted revenues, high margins, and high renewal rates as attractive qualities of the company’s business model.

SELLS/LIQUIDATIONS

Berkshire Hills Bancorp (BHLB), is a regional bank primarily serving the NY and New England area. The company announced a merger of equals with Brookline Bancorp. After re-underwriting the combined organization, we chose to exit our position as we were not comfortable with the new management team, nor with the significantly increased loan to deposit ratio.

Columbus McKinnon (CMCO), engages in the design, manufacture, and marketing of material handling products and systems. After carefully assessing the company’s announced acquisition of Kito-Crosby, and choice of convertible preferred equity to finance the deal, we felt the dramatic shift away from a long-standing strategy of smaller, technology forward acquisitions combined in a meaningfully increased financial leverage profile justified selling the position.

JBG SMITH Properties (JBGS), a Washington, DC-focused real estate investment trust that develops, owns and operates a portfolio of mixed-use properties (multifamily, commercial, development and land assets). Concerns related to the company’s capital allocation plans along with deteriorating fundamentals in their core operating market prompted our decision to exit the position.

Monro (MNRO), operates a chain of approximately 1,200 automotive repair and tire retail stores. Ongoing weak demand had weighed on the company’s profitability for longer than anticipated and with expectations for continued economic pressures for their core low-income customers, we decided to exit the position.

Tronox (TROX), a leading global manufacturer of titanium dioxide (TiO2) pigment, a key ingredient in paint, plastics and a variety of other industrial applications. We believe the company is well positioned to benefit from increased production volumes and product pricing driven by improving global economic conditions. However, an increasingly uncertain economic outlook as a result of the threat of increased global tariffs pushed out the expected demand recovery combined with a cyclically driven stressed balance sheet caused us to exit the position.

Outlook

We continue to remain optimistic about the long-term potential for the small-cap segment of the U.S. market. Valuations remain compelling relative to large caps, with the Russell 2000 Index trading near multi-decade lows on a relative basis. Potential tailwinds, including deregulation, lower corporate tax rate, increased M&A activity, continued reshoring of U.S. manufacturing, and infrastructure-related spending, could provide additional support for small-cap stocks. We have experienced some short-term volatility related to the current administration’s policies and legislation. We also remain mindful of risks such as inflation reaccelerating, increased geopolitical tensions, and potential U.S. economic weakness.

Positioning

Our current positioning is a function of our bottom-up security selection process and our ability to identify what we view as attractive investment candidates, regardless of economic sector definitions. Overweight allocations in Information Technology and Industrials are mostly a function of our underlying company specific views rather than any top-down predictions for each sector. Conversely, we continue to be underweight in Consumer Discretionary, as we have been unable to identify what we consider to be compelling long-term opportunities that fit our discipline given the rising risk profiles of many retail businesses and a potential deceleration in goods spending following a period of strength. We are also underweight in Financials as the sector has experienced strong returns, leading us to harvest gains and redeploy the proceeds to what we consider to be more attractive reward to risk opportunities. Given our focus on long-term business fundamentals, our patient investment approach and low portfolio turnover, the strategy’s sector positioning generally does not change significantly from quarter to quarter. However, we may take advantage of periods of volatility by adding selectively to certain companies when appropriate.

|

Disclosures The opinions expressed herein are those of Aristotle Capital Boston, LLC (Aristotle Boston) and are subject to change without notice. Past performance is not indicative of future results. The information provided in this report should not be considered financial advice or a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and, in the aggregate, may represent only a small percentage of an account’s portfolio holdings. The performance attribution presented is of a representative account from Aristotle Boston’s Small Cap Equity Composite. The representative account is a discretionary client account which was chosen to most closely reflect the investment style of the strategy. The criteria used for representative account selection is based on the account’s period of time under management and its similarity of holdings in relation to the strategy. It should not be assumed that any of the securities transactions, holdings or sectors discussed were or will be profitable, or that the investment recommendations or decisions Aristotle Boston makes in the future will be profitable or equal the performance of the securities discussed herein. Aristotle Boston reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. Recommendations made in the last 12 months are available upon request. Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses. Effective January 1, 2022, the Aristotle Small Cap Equity Composite has been redefined to exclude accounts with meaningful industry-specific restrictions or substantial values-based screens hampering implementation of the small cap strategy. All investments carry a certain degree of risk, including the possible loss of principal. Investments are also subject to political, market, currency and regulatory risks or economic developments. International investments involve special risks that may in particular cause a loss in principal, including currency fluctuation, lower liquidity, different accounting methods and economic and political systems, and higher transaction costs. These risks typically are greater in emerging markets. While Large-capitalization companies may have more stable prices than smaller, less established companies, they are still subject to equity securities risk. In addition, large-capitalization equity security prices may not rise as much as prices of equity securities of small-capitalization companies. Securities of small- and medium-sized companies tend to have a shorter history of operations, be more volatile and less liquid. Value stocks can perform differently from the market as a whole and other types of stocks. The material is provided for informational and/or educational purposes only and is not intended to be and should not be construed as investment, legal or tax advice and/or a legal opinion. Investors should consult their financial and tax adviser before making investments. The opinions referenced are as of the date of publication, may be modified due to changes in the market or economic conditions, and may not necessarily come to pass. Information and data presented has been developed internally and/or obtained from sources believed to be reliable. Aristotle Boston does not guarantee the accuracy, adequacy or completeness of such information. Aristotle Capital Boston, LLC is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about Aristotle Boston, including our investment strategies, fees and objectives, can be found in our Form ADV Part 2, which is available upon request. ACB-2507-12 Performance Disclosures   Sources: CAPS Composite Hub, Russell Investments Composite returns for periods ended June 30, 2025, are preliminary pending final account reconciliation. *The Aristotle Small Cap Equity Composite has an inception date of November 1, 2006, at a predecessor firm. During this time, Jack McPherson and Dave Adams had primary responsibility for managing the strategy. Performance starting January 1, 2015, was achieved at Aristotle Boston. **For the period November 2006 through December 2006. Past performance is not indicative of future results. Performance results for periods greater than one year have been annualized. Effective January 1, 2022, the Aristotle Small Cap Equity Composite has been redefined to exclude accounts with meaningful industry-specific restrictions or substantial values-based screens hampering implementation of the small cap strategy. Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses. Please see important disclosures enclosed within this document. Index Disclosures The Russell 2000® Index measures the performance of the small cap segment of the U.S. equity universe. The Russell 2000 Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership. The Russell 2000 Growth® Index measures the performance of the small cap companies located in the United States that also exhibit a growth probability. The Russell 2000 Value® Index measures the performance of the small cap companies located in the United States that also exhibit a value probability. The volatility (beta) of the composite may be greater or less than the benchmarks. It is not possible to invest directly in these indices. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here